How to enable VAT for your Business (as a VAT Registered Business entity)

Are you a VAT registered vendor? Here's how you can enable VAT functionality on your Merchant profile.

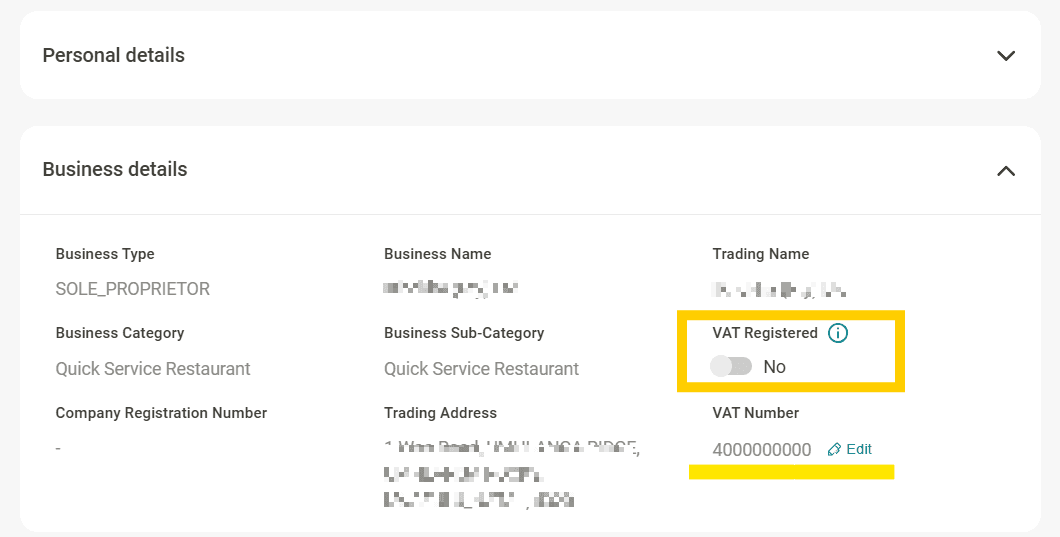

If your business is VAT registered, you’ll want your transactions, invoices, and receipts to clearly show VAT for compliance and transparency. iKhokha makes this simple with a centralised VAT functionality in your Merchant Dashboard. This feature ensures that every sale includes the correct VAT calculation (15%) and that your VAT number is displayed on all customer-facing documents.

What is VAT functionality

VAT functionality is a feature that allows VAT calculations (15%) to be made visible in each of the transaction calculations when selling to Customers.

Before January 2025, VAT registered Merchants would have been required to set a VAT status in the settings of each device they had active against their Business profile. At the start of 2025 a single centralised VAT setting has been made available in the Profile section of the Merchant Dashboard.

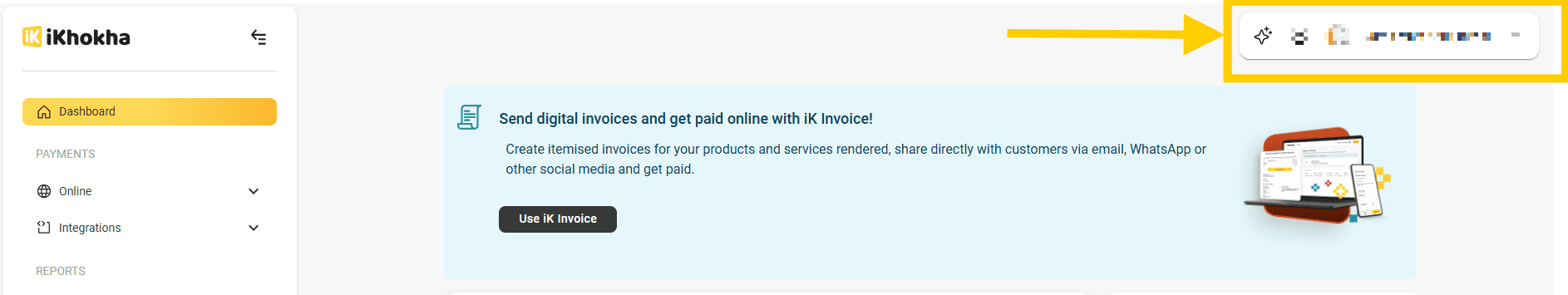

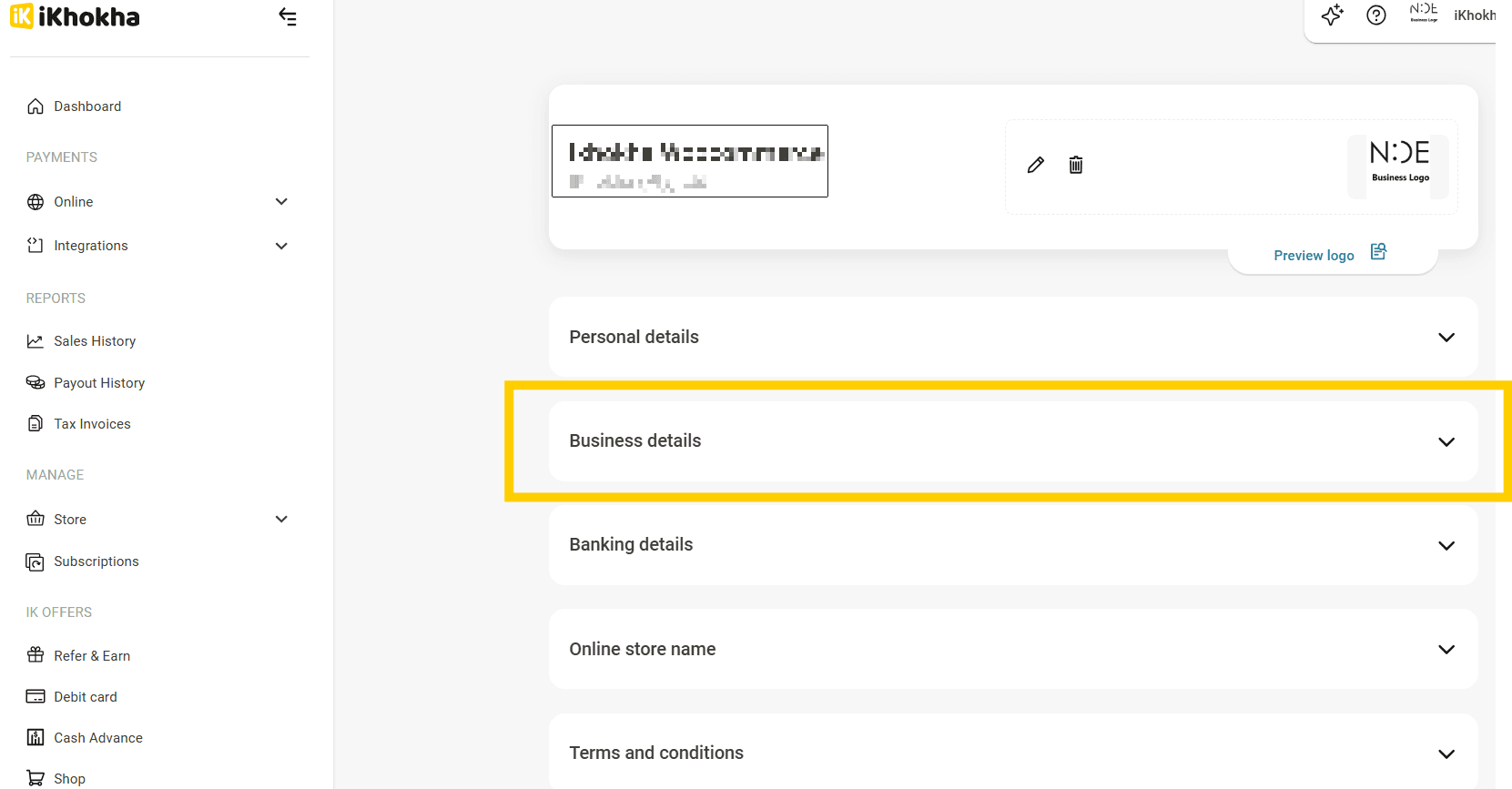

How to turn on VAT functionality

Whether you have chosen to use the Product & Services Catalogue feature or not, enabling VAT for your Business is found under the Business Details view of your Merchant profile.

Follow the steps below to ensure that VAT calculations become visible for all sales made, along with displaying your VAT number in all customer facing documents (invoicing & receipts).