How to enable VAT functionality on your iK Shaker Solo

Are you a VAT registered vendor? Here’s how you can enable VAT functionality on your iK Shaker Solo.

What is VAT Functionality?

VAT functionality is a feature on the iK Shaker Solo that allows you to calculate VAT automatically on each transaction and view VAT on receipts and back-end reports.

The feature calculates 15% of the VAT-inclusive price and shows you the VAT total of your transaction on receipts and reports.

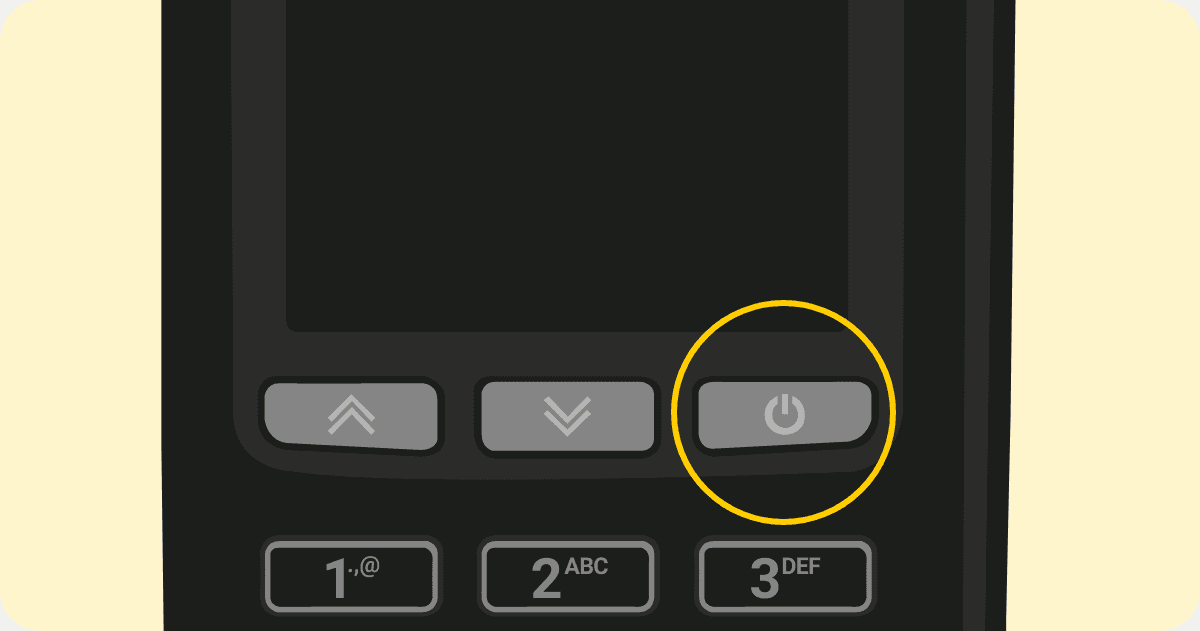

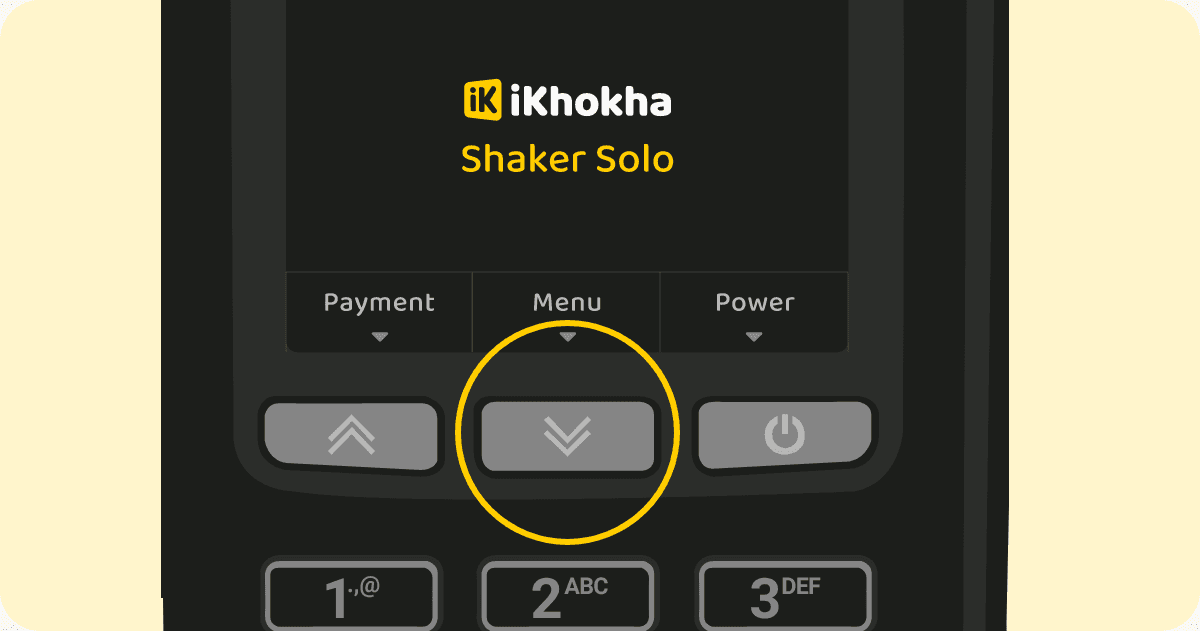

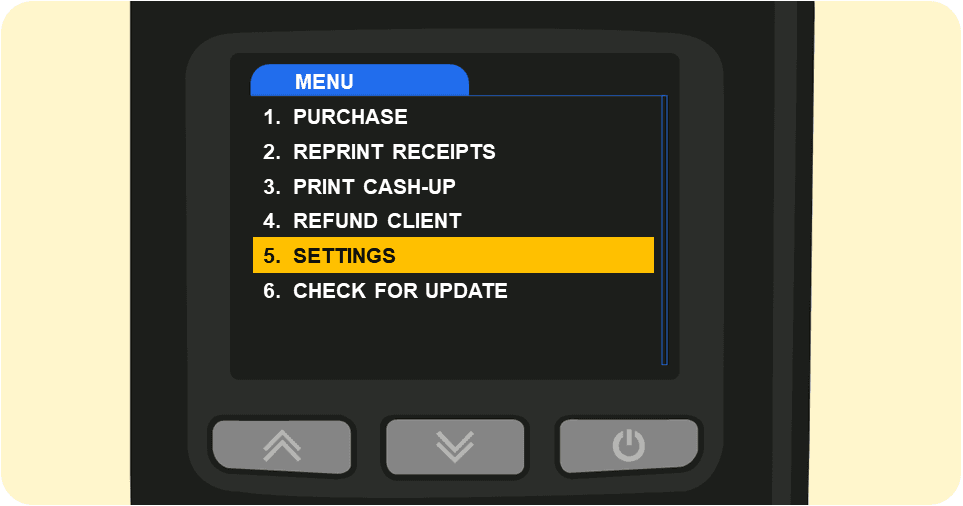

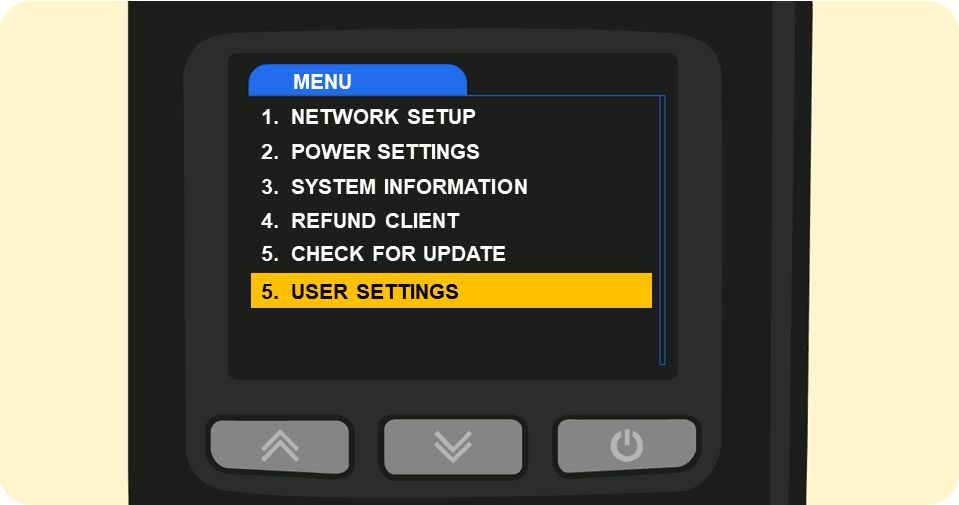

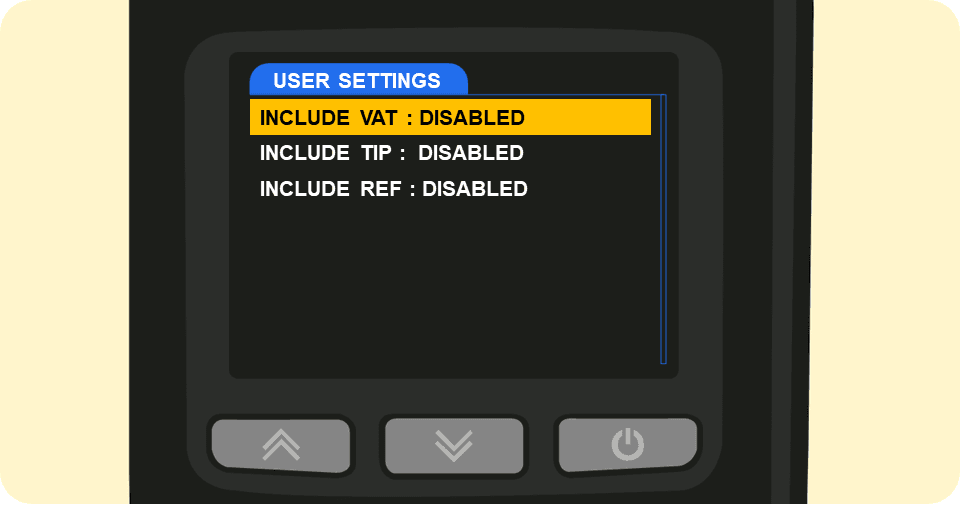

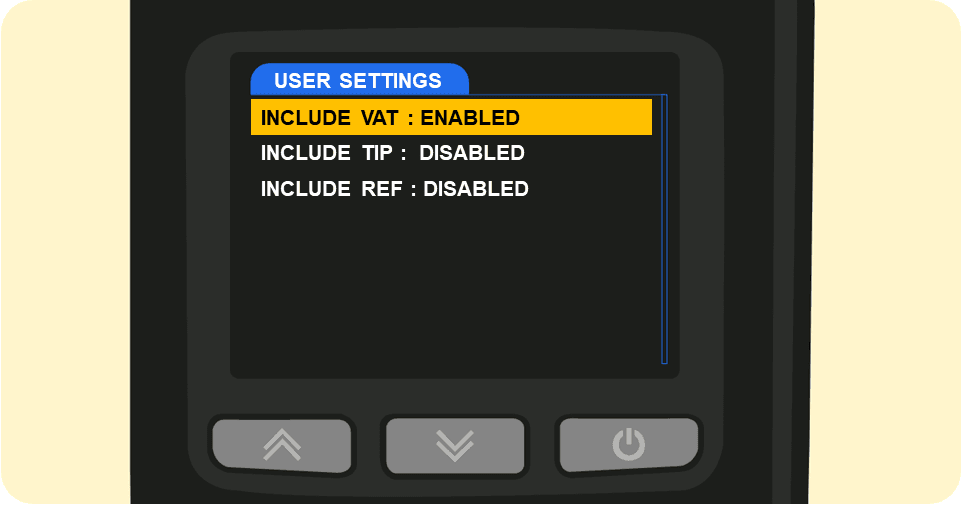

How to turn on VAT Functionality

Follow the steps below to enable the VAT functionality on your iK Shaker Solo:

For further assistance please do not hesitate to contact us. You may send an email to support@ikhokha.com or call our iKhokha support line at 087 222 7000, and we will be delighted to provide the necessary aid.